DVN Devon Energy

eröffnet am 05.03.23 15:45:31 von

neuester Beitrag 24.05.24 10:35:00 von

neuester Beitrag 24.05.24 10:35:00 von

Beiträge: 21

ID: 1.367.289

ID: 1.367.289

Aufrufe heute: 1

Gesamt: 2.900

Gesamt: 2.900

Aktive User: 0

ISIN: US25179M1036 · WKN: 925345 · Symbol: DVN

48,15

USD

-0,17 %

-0,08 USD

Letzter Kurs 25.05.24 NYSE

Meistbewertete Beiträge

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 07.05.24 |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,6500 | +34,52 | |

| 1,8900 | +24,34 | |

| 4,6300 | +16,33 | |

| 3,2600 | +15,19 | |

| 1,1700 | +13,59 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,9800 | -7,48 | |

| 17,250 | -9,21 | |

| 0,5170 | -13,15 | |

| 0,6705 | -31,58 | |

| 3,0600 | -34,83 |

Beitrag zu dieser Diskussion schreiben

Ernüchternd….

Jetzt wäre doch die Gelegenheit, Aktien zurückzukaufen

Jetzt wäre doch die Gelegenheit, Aktien zurückzukaufen

Ohne Widerstand durchgebrochen.

Nächster Halt, 200er?

Ich hoffe nur, das Devon ordentlich zurückkauft.

Somit den Kurs einigermaßen stabilisiert.

Bei einer Ankündigung, 3 Milliarden rückzukaufen und dann im Quartal 200 Millionen nur umzusetzen…

Schwache Vorstellung.

Nächster Halt, 200er?

Ich hoffe nur, das Devon ordentlich zurückkauft.

Somit den Kurs einigermaßen stabilisiert.

Bei einer Ankündigung, 3 Milliarden rückzukaufen und dann im Quartal 200 Millionen nur umzusetzen…

Schwache Vorstellung.

Einen Gefallen mit den Rückkäufen tut Devon den Langzeitinvestoren jedenfalls nicht.

Eine höhere Dividende gefiel mir jedenfalls besser.

Hoffen wir, dass die 50er wenigstens hält.

Obwohl ich dies bezweifle.

Öl nähert sich dem 3 Monatstief

Eine höhere Dividende gefiel mir jedenfalls besser.

Hoffen wir, dass die 50er wenigstens hält.

Obwohl ich dies bezweifle.

Öl nähert sich dem 3 Monatstief

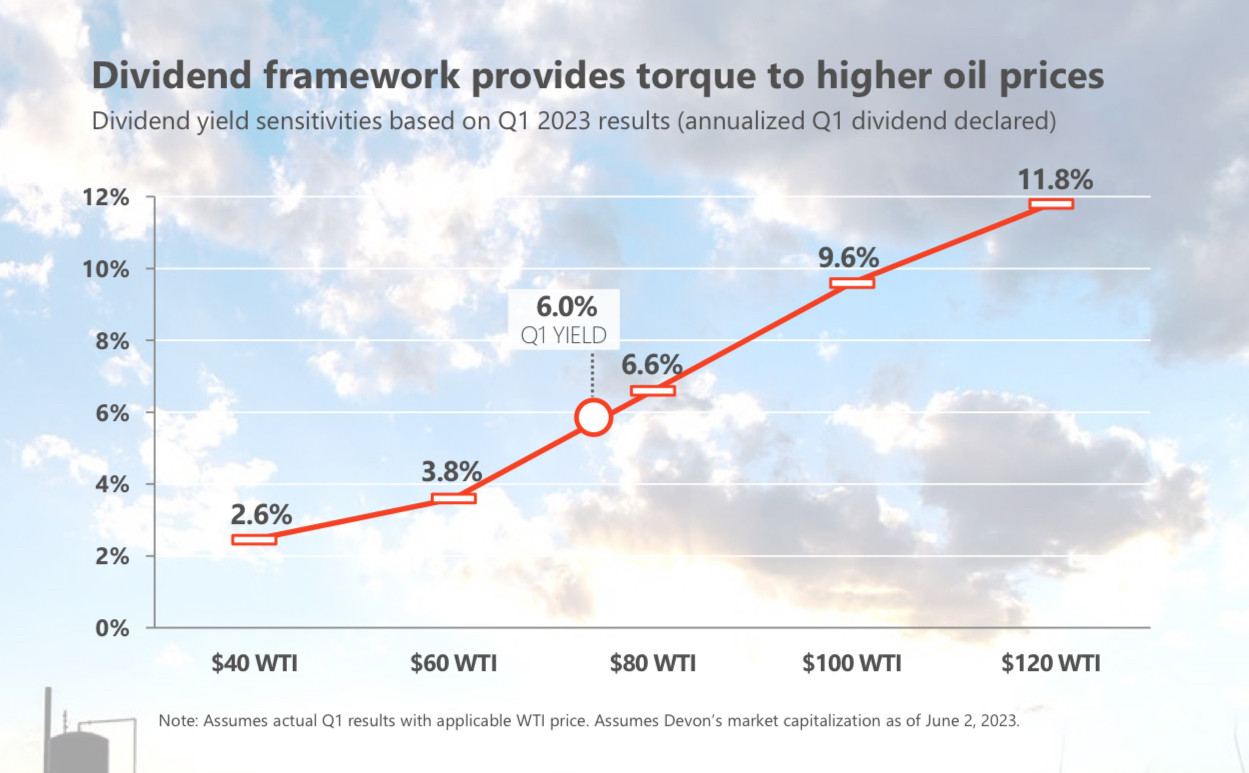

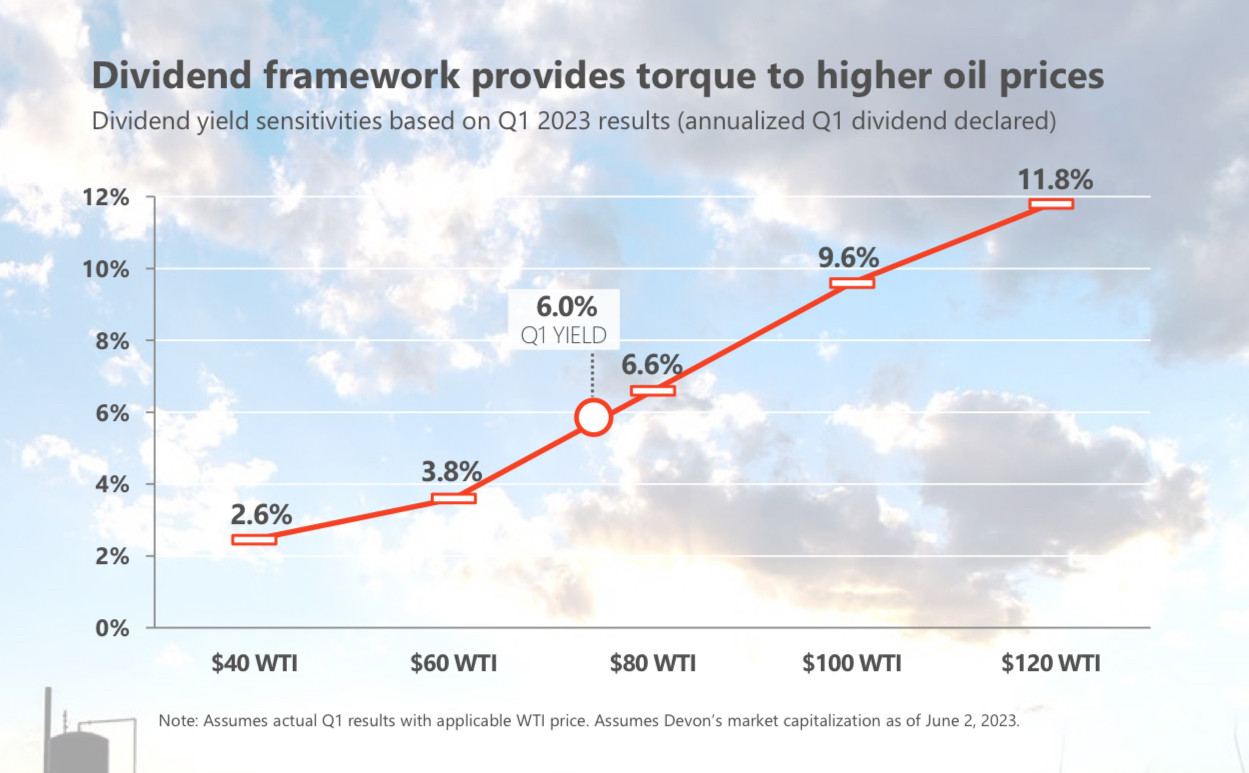

Antwort auf Beitrag Nr.: 75.744.999 von winston-wolfe am 07.05.24 15:41:16Zu finden ist dies in der Präsentation vom 07 Juni 2023.

Über die Gültigkeit kann ich nichts sagen.

Über die Gültigkeit kann ich nichts sagen.

Antwort auf Beitrag Nr.: 75.742.095 von beton0815 am 07.05.24 09:55:01Von wann ist diese Präsentation, in der aktuellen zu Q1 2024 konnte ich diesen Slide nicht finden? Dort wird auch betont, dass das Aktienrückkaufprogramm im Moment bevorzugt wird. Wird dem einen gefallen, dem anderen nicht ...

Zitat von beton0815: Basierend auf dem Ölpreis je Quartal wird die Dividende eingestuft

https://investors.devonenergy.com/investors/events-presentat…

Basierend auf dem Ölpreis je Quartal wird die Dividende eingestuft

https://investors.devonenergy.com/investors/events-presentat…

https://investors.devonenergy.com/investors/events-presentat…

Devon Energy's Decision to De-Emphasize the Dividend Could Pay Off

By Matt DiLallo – May 4, 2024 at 4:25AM

KEY POINTS

Devon Energy's variable dividend continues to go down.

The oil company is prioritizing share repurchases this year.

Those buybacks could boost its growth rate and valuation in the future.

The oil company has shifted its capital return strategy toward share repurchases.

Devon Energy (DVN 0.63%) has been a monster dividend stock in recent years. A few years ago, the oil company launched the industry's first fixed-plus-variable dividend framework. It aimed to pay a fixed base dividend each quarter and up to 50% of its excess free cash flow in variable dividends.

Higher oil prices in 2022 sent its free cash flow and variable dividend payments soaring.

However, the company shifted its capital return framework this year to give it more flexibility.

As a result, its dividend payment was much lower in the first quarter as it emphasized repurchasing its shares.

That change could pay off for shareholders in the long run.

...

https://www.fool.com/investing/2024/05/04/devon-energys-deci…

By Matt DiLallo – May 4, 2024 at 4:25AM

KEY POINTS

Devon Energy's variable dividend continues to go down.

The oil company is prioritizing share repurchases this year.

Those buybacks could boost its growth rate and valuation in the future.

The oil company has shifted its capital return strategy toward share repurchases.

Devon Energy (DVN 0.63%) has been a monster dividend stock in recent years. A few years ago, the oil company launched the industry's first fixed-plus-variable dividend framework. It aimed to pay a fixed base dividend each quarter and up to 50% of its excess free cash flow in variable dividends.

Higher oil prices in 2022 sent its free cash flow and variable dividend payments soaring.

However, the company shifted its capital return framework this year to give it more flexibility.

As a result, its dividend payment was much lower in the first quarter as it emphasized repurchasing its shares.

That change could pay off for shareholders in the long run.

...

https://www.fool.com/investing/2024/05/04/devon-energys-deci…

Devon zahlt am 28.06.2024 0.35$ Dividende je Aktie

0.22$ Regulär

0.13$ Special

Sollte im nächsten Quartal höher ausfallen, wenn der Ölpreis auf diesem Niveau bleibt

Quelle:

https://www.devonenergy.com/news/2024/Devon-Energy-Reports-F…" target="_blank" rel="nofollow ugc noopener"> https://www.devonenergy.com/news/2024/Devon-Energy-Reports-F…

0.22$ Regulär

0.13$ Special

Sollte im nächsten Quartal höher ausfallen, wenn der Ölpreis auf diesem Niveau bleibt

Quelle:

https://www.devonenergy.com/news/2024/Devon-Energy-Reports-F…" target="_blank" rel="nofollow ugc noopener"> https://www.devonenergy.com/news/2024/Devon-Energy-Reports-F…

Strong industry dynamics have an analyst bullish on Devon Energy's prospects

Outperforming the 6.3% rise of the S&P 500 so far in 2024, energy specialist Devon Energy (DVN 0.84%) powered 16% higher from the start of the year.

And Biju Perincheril, an analyst at Susquehanna, thinks that there's even more room for the oil and gas producer's stock to run. Perincheril this week raised his price target on shares of Devon Energy by 25% to $65 from $52.

Based on the stock's current share price of $52.56, Perincheril's price target implies an upside of 23.7% over the next 12 months or so.

Updating its estimates for the exploration and production niche of the oil industry, Susquehanna foresees companies committing to increasing energy production.

This, in part, forms the basis for Susquehanna's upwardly revised price target on Devon Energy, according to financial news website The Fly.

Come for the higher price target, stay for the dividends

For energy investors who have Devon Energy on their radars, Susquehanna's higher estimate for the company's stock is surely an encouraging bit of news. It's important, however, to remember that analysts frequently have time horizons much shorter than the multiyear holding periods that the Motley Fool favors, so it's wise to remember that Susquehanna's optimistic outlook is focused on relatively short-term results.

That being said, Devon Energy is certainly a worthy addition to the portfolios of income investors looking to fortify their passive income streams. The stock has a forward dividend yield of 4.7% right now. The company's innovative dividend policy pairs a fixed dividend payment with a variable dividend based on excess free cash flow. That makes it a great option for income investors willing to play in the oil patch -- especially with the company targeting to return 70% of excess 2024 free cash flow to investors.

...

https://www.fool.com/investing/2024/04/23/devon-energy-stock…

Outperforming the 6.3% rise of the S&P 500 so far in 2024, energy specialist Devon Energy (DVN 0.84%) powered 16% higher from the start of the year.

And Biju Perincheril, an analyst at Susquehanna, thinks that there's even more room for the oil and gas producer's stock to run. Perincheril this week raised his price target on shares of Devon Energy by 25% to $65 from $52.

Based on the stock's current share price of $52.56, Perincheril's price target implies an upside of 23.7% over the next 12 months or so.

Updating its estimates for the exploration and production niche of the oil industry, Susquehanna foresees companies committing to increasing energy production.

This, in part, forms the basis for Susquehanna's upwardly revised price target on Devon Energy, according to financial news website The Fly.

Come for the higher price target, stay for the dividends

For energy investors who have Devon Energy on their radars, Susquehanna's higher estimate for the company's stock is surely an encouraging bit of news. It's important, however, to remember that analysts frequently have time horizons much shorter than the multiyear holding periods that the Motley Fool favors, so it's wise to remember that Susquehanna's optimistic outlook is focused on relatively short-term results.

That being said, Devon Energy is certainly a worthy addition to the portfolios of income investors looking to fortify their passive income streams. The stock has a forward dividend yield of 4.7% right now. The company's innovative dividend policy pairs a fixed dividend payment with a variable dividend based on excess free cash flow. That makes it a great option for income investors willing to play in the oil patch -- especially with the company targeting to return 70% of excess 2024 free cash flow to investors.

...

https://www.fool.com/investing/2024/04/23/devon-energy-stock…

Citigroup raises Devon Energy's price target on output, M&A potential

bin ja voll der Alleinunterhalter hier

** Brokerage Citigroup raises Devon Energy's DVN.N price target to $62 from $55, shares up marginally in premarket trading

** Says there is an upside to production and rising prospects of big M&A

** Says "DVN presents one of the more debated E&P stories in 2024 given the potential for an operational turnaround"

** "The market would respond positively to a DVN/MRO merger given the synergy potential and FCF accretion under a merger of equals/small premium scenario," Citigroup analysts say in a note

** The new price target represents a 13.7% upside to the stock's last close

** 20 of 30 brokerages rate the stock "buy" or higher and 10 "hold"; their median PT is $54

** Up to the last closing price, shares up 20.3% YTD

...

https://www.xm.com/research/markets/allNews/reuters/citigrou…

bin ja voll der Alleinunterhalter hier

** Brokerage Citigroup raises Devon Energy's DVN.N price target to $62 from $55, shares up marginally in premarket trading

** Says there is an upside to production and rising prospects of big M&A

** Says "DVN presents one of the more debated E&P stories in 2024 given the potential for an operational turnaround"

** "The market would respond positively to a DVN/MRO merger given the synergy potential and FCF accretion under a merger of equals/small premium scenario," Citigroup analysts say in a note

** The new price target represents a 13.7% upside to the stock's last close

** 20 of 30 brokerages rate the stock "buy" or higher and 10 "hold"; their median PT is $54

** Up to the last closing price, shares up 20.3% YTD

...

https://www.xm.com/research/markets/allNews/reuters/citigrou…

Plug Power, AT&T und Co: Jim Cramer hasst diese 11 Aktien – aber milliardenschwere Investoren lieben sie!(1) 28.01.24 · wallstreetONLINE Redaktion · Verizon Communications |

10.01.24 · wallstreetONLINE NewsUpdate · Devon Energy |

10.01.24 · wallstreetONLINE Redaktion · Devon Energy |

10.01.24 · wallstreetONLINE NewsUpdate · Devon Energy |