HECLA MINING - Entwicklung zum Major Player (Seite 5)

eröffnet am 04.03.08 05:38:51 von

neuester Beitrag 27.05.24 18:15:57 von

neuester Beitrag 27.05.24 18:15:57 von

Beiträge: 24.228

ID: 1.139.154

ID: 1.139.154

Aufrufe heute: 1

Gesamt: 1.067.575

Gesamt: 1.067.575

Aktive User: 0

ISIN: US4227041062 · WKN: 854693 · Symbol: HCL

5,4340

EUR

+0,70 %

+0,0380 EUR

Letzter Kurs 31.05.24 Tradegate

Neuigkeiten

| TitelBeiträge |

|---|

29.05.24 · wallstreetONLINE Redaktion |

23.05.24 · Business Wire (engl.) |

20.05.24 · Business Wire (engl.) |

19.05.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 74,01 | +99.999,00 | |

| 1,0000 | +53,85 | |

| 1.056,00 | +17,69 | |

| 794,35 | +12,21 | |

| 0,5500 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 52,80 | -6,99 | |

| 25,56 | -7,96 | |

| 2,3900 | -8,08 | |

| 0,6300 | -16,56 | |

| 46,92 | -98,01 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 74.762.858 von Dirkix am 07.11.23 20:44:17

Aktuell der beste Silberminer...meine Meinung! Keno wird eine Cash Cow. Bin mal gespannt, ob wir uns auch Metallic Minerals einverleiben.

Danke für die Zahlen/Info.

Gruß Lenny

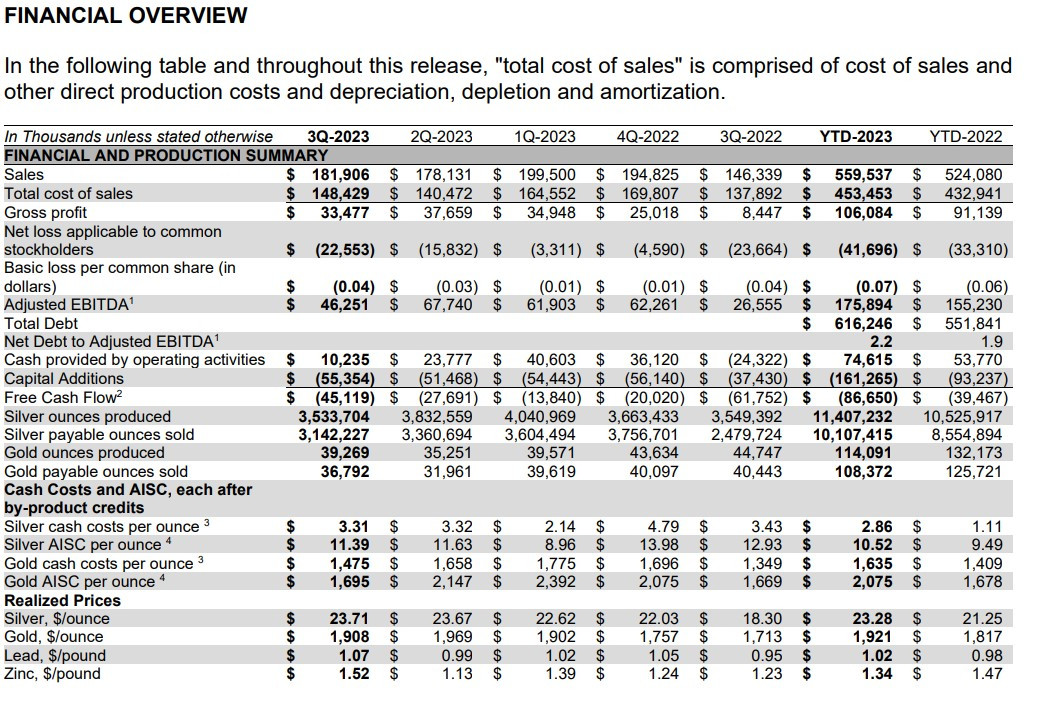

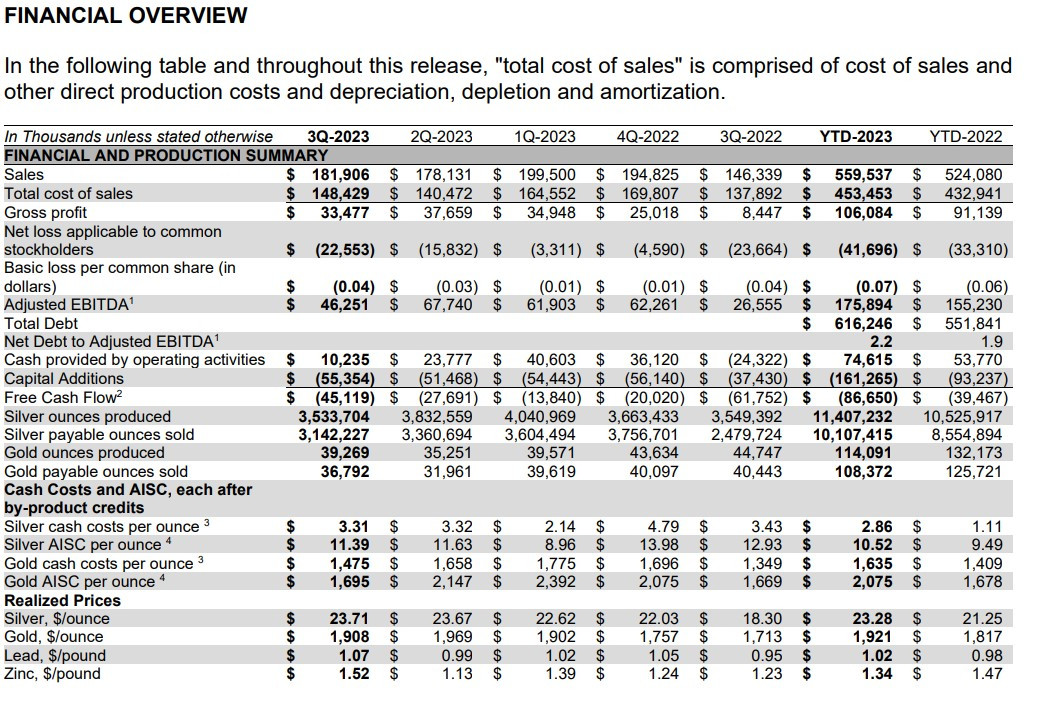

Zitat von Dirkix: Q3 Zahlen sind durchwachsen, negativ waren die zusätzliche Kosten von Lucky Friday suspension (returning to production in early 2024), ramp-up of Keno Hill und Casa Berardi 21-day suspension in June due to the Quebec wildfires.

Positiv:

Cash and cash equivalents at the end of the third quarter were $100.7 million

AISC hervorragend!!!

Silver AISC per ounce: $11.39

Gold AISC per ounce $ 1,695

Erzielte Preis auch Hervorragend, gerade im Hinblick auf die Gold- und Silberkurse im dritten Quartal!

Realized Prices

Silver, $/ounce 23.71

Gold, $/ounce 1,908

Hecla Reports Third Quarter 2023 Results

Tue, November 7, 2023

COEUR D'ALENE, Idaho -- Hecla Mining Company (NYSE:HL) today announced third quarter 2023 operating and financial results.

THIRD QUARTER HIGHLIGHTS

Operational

Produced 3.5 million ounces of silver and 11.4 million ounces year to date ("YTD").

Continued ramping up Keno Hill, producing 0.7 million ounces of silver.

Casa Berardi began to transition to an open pit only operation, producing 24,259 ounces of gold, with total cost of sales of $56.8 million and an All-in Sustaining Cost ("AISC") per gold ounce of $1,695.4

Lucky Friday on track to resume operations at the beginning of 2024.

Gold production guidance reiterated, with gold cash cost guidance lowered.

Greens Creek silver production guidance increased, offset by lower anticipated production at Keno Hill; consolidated silver cost guidance affirmed.

Financial

Sales of $181.9 million, with 38% from silver and 36% from gold.

Consolidated silver total cost of sales of $90.7 million and cash cost and AISC per silver ounce (each after by-product credits) of $3.31 and $11.39, respectively.3,4

Cash flow from operations of $10.2 million; $74.6 million YTD; with Greens Creek generating $36.1 million in cash flow from operations for the quarter and $122.7 million YTD.

Greens Creek generated $28.3 million in free cash flow for the quarter, $101.7 million YTD.2

Net loss applicable to common stockholders of ($22.6) million or ($0.04) per share and adjusted net loss applicable to common stockholders of ($3.5) million or ($0.01) per share.

Hecla is the largest silver producer in the U.S. and will be Canada's largest when Keno Hill achieves full production.

Hecla is the fastest-growing established silver producer, and we expect to produce up to 20 million ounces of silver by 2025.

Because silver is a key component in solar power generation, which is the fastest growing source of renewable energy, Hecla will be a direct contributor to the energy transition.

...

https://s29.q4cdn.com/244919359/files/doc_news/2023/11/31-Q3…

Aktuell der beste Silberminer...meine Meinung! Keno wird eine Cash Cow. Bin mal gespannt, ob wir uns auch Metallic Minerals einverleiben.

Danke für die Zahlen/Info.

Gruß Lenny

Q3 Zahlen sind durchwachsen, negativ waren die zusätzliche Kosten von Lucky Friday suspension (returning to production in early 2024), ramp-up of Keno Hill und Casa Berardi 21-day suspension in June due to the Quebec wildfires.

Positiv:

Cash and cash equivalents at the end of the third quarter were $100.7 million

AISC hervorragend!!!

Silver AISC per ounce: $11.39

Gold AISC per ounce $ 1,695

Erzielte Preis auch Hervorragend, gerade im Hinblick auf die Gold- und Silberkurse im dritten Quartal!

Realized Prices

Silver, $/ounce 23.71

Gold, $/ounce 1,908

Hecla Reports Third Quarter 2023 Results

Tue, November 7, 2023

COEUR D'ALENE, Idaho -- Hecla Mining Company (NYSE:HL) today announced third quarter 2023 operating and financial results.

THIRD QUARTER HIGHLIGHTS

Operational

Produced 3.5 million ounces of silver and 11.4 million ounces year to date ("YTD").

Continued ramping up Keno Hill, producing 0.7 million ounces of silver.

Casa Berardi began to transition to an open pit only operation, producing 24,259 ounces of gold, with total cost of sales of $56.8 million and an All-in Sustaining Cost ("AISC") per gold ounce of $1,695.4

Lucky Friday on track to resume operations at the beginning of 2024.

Gold production guidance reiterated, with gold cash cost guidance lowered.

Greens Creek silver production guidance increased, offset by lower anticipated production at Keno Hill; consolidated silver cost guidance affirmed.

Financial

Sales of $181.9 million, with 38% from silver and 36% from gold.

Consolidated silver total cost of sales of $90.7 million and cash cost and AISC per silver ounce (each after by-product credits) of $3.31 and $11.39, respectively.3,4

Cash flow from operations of $10.2 million; $74.6 million YTD; with Greens Creek generating $36.1 million in cash flow from operations for the quarter and $122.7 million YTD.

Greens Creek generated $28.3 million in free cash flow for the quarter, $101.7 million YTD.2

Net loss applicable to common stockholders of ($22.6) million or ($0.04) per share and adjusted net loss applicable to common stockholders of ($3.5) million or ($0.01) per share.

Hecla is the largest silver producer in the U.S. and will be Canada's largest when Keno Hill achieves full production.

Hecla is the fastest-growing established silver producer, and we expect to produce up to 20 million ounces of silver by 2025.

Because silver is a key component in solar power generation, which is the fastest growing source of renewable energy, Hecla will be a direct contributor to the energy transition.

...

https://s29.q4cdn.com/244919359/files/doc_news/2023/11/31-Q3…

Positiv:

Cash and cash equivalents at the end of the third quarter were $100.7 million

AISC hervorragend!!!

Silver AISC per ounce: $11.39

Gold AISC per ounce $ 1,695

Erzielte Preis auch Hervorragend, gerade im Hinblick auf die Gold- und Silberkurse im dritten Quartal!

Realized Prices

Silver, $/ounce 23.71

Gold, $/ounce 1,908

Hecla Reports Third Quarter 2023 Results

Tue, November 7, 2023

COEUR D'ALENE, Idaho -- Hecla Mining Company (NYSE:HL) today announced third quarter 2023 operating and financial results.

THIRD QUARTER HIGHLIGHTS

Operational

Produced 3.5 million ounces of silver and 11.4 million ounces year to date ("YTD").

Continued ramping up Keno Hill, producing 0.7 million ounces of silver.

Casa Berardi began to transition to an open pit only operation, producing 24,259 ounces of gold, with total cost of sales of $56.8 million and an All-in Sustaining Cost ("AISC") per gold ounce of $1,695.4

Lucky Friday on track to resume operations at the beginning of 2024.

Gold production guidance reiterated, with gold cash cost guidance lowered.

Greens Creek silver production guidance increased, offset by lower anticipated production at Keno Hill; consolidated silver cost guidance affirmed.

Financial

Sales of $181.9 million, with 38% from silver and 36% from gold.

Consolidated silver total cost of sales of $90.7 million and cash cost and AISC per silver ounce (each after by-product credits) of $3.31 and $11.39, respectively.3,4

Cash flow from operations of $10.2 million; $74.6 million YTD; with Greens Creek generating $36.1 million in cash flow from operations for the quarter and $122.7 million YTD.

Greens Creek generated $28.3 million in free cash flow for the quarter, $101.7 million YTD.2

Net loss applicable to common stockholders of ($22.6) million or ($0.04) per share and adjusted net loss applicable to common stockholders of ($3.5) million or ($0.01) per share.

Hecla is the largest silver producer in the U.S. and will be Canada's largest when Keno Hill achieves full production.

Hecla is the fastest-growing established silver producer, and we expect to produce up to 20 million ounces of silver by 2025.

Because silver is a key component in solar power generation, which is the fastest growing source of renewable energy, Hecla will be a direct contributor to the energy transition.

...

https://s29.q4cdn.com/244919359/files/doc_news/2023/11/31-Q3…

Antwort auf Beitrag Nr.: 74.734.538 von Dirkix am 02.11.23 11:06:59

Was geht...

..an der Aktie wird man noch viel Freude haben.

Das nennt man wohl einen Fuß in der Tür...!

Hecla ups stake in Dolly Varden Silver to 15.7%

Dolly Varden Silver Corp. said it has entered an agreement for a further strategic investment by Hecla Canada Ltd., a unit of U.S. precious metals giant Hecla Mining.

The company said Hecla Canada has agreed to subscribe for 15.4 million common shares of Dolly Varden at a price of $0.65 per share, generating gross proceeds of $10 million,

and raising Hecla’s stake in the junior to 15.7% from 10.6%.

“Hecla’s support for Dolly Varden Silver’s Kitsault Valley Project in B.C.’s prolific Golden Triangle is validated with today’s financing news,’’ said Dolly Varden CEO Shawn Khunkhun. “Hecla is the world’s fastest growing established silver producer and the largest in the U.S. and soon to be in Canada.’’

Dolly Varden said $6 million of the net proceeds of the offering will be used for exploration, mineral resource expansion and related costs in the Kitsault Valley project, with the balance to be used for working capital and G&A costs.

Dolly Varden shares advanced on the news, rising 2.8% or $0.02 to 72 cents. The shares trade in a 52-week range of $1.24 and 56 cents.

In connection with the offering, Dolly Varden has agreed with Hecla that the company will not complete any further debt of equity financings for the remainder of 2023. Additionally, Dolly Varden has agreed that between January 1, 2024 and September 1, 2024, without the consent of Hecla, it will not complete any debt or equity financings other than equity financings for net proceeds to the company of up to $15 million and provided that the issue price under such financings is greater than $0.65 per security.

Dolly Varden is focused on advancing the wholly-owned Kitsault Valley Project, which covers 163 square kilometres and hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge along with the past producing Dolly Varden and Torbit silver mines.

The entire property is considered to be highly prospective for hosting high-grade precious metal deposits since it comprises the same structural and stratigraphic setting that hosts numerous other on-trend, high-grade deposits, including Eskay Creek and Brucejack.

The property is also considered to be an advanced exploration stage property with targets that are well understood. However, the company has said mine restarts will require the discovery of additional silver resources and the confirmation of historic resources that were known at the cessation of mining in 1959.

Dolly Varden is a member of the British Columbia Regional Mining Alliance (BCRMA), which was set up by the B.C. Government along with First Nations, and several exploration companies from B.C.’s northwest region to promote B.C.’s mining opportunities internationally.

Hecla ups stake in Dolly Varden Silver to 15.7%

Dolly Varden Silver Corp. said it has entered an agreement for a further strategic investment by Hecla Canada Ltd., a unit of U.S. precious metals giant Hecla Mining.

The company said Hecla Canada has agreed to subscribe for 15.4 million common shares of Dolly Varden at a price of $0.65 per share, generating gross proceeds of $10 million,

and raising Hecla’s stake in the junior to 15.7% from 10.6%.

“Hecla’s support for Dolly Varden Silver’s Kitsault Valley Project in B.C.’s prolific Golden Triangle is validated with today’s financing news,’’ said Dolly Varden CEO Shawn Khunkhun. “Hecla is the world’s fastest growing established silver producer and the largest in the U.S. and soon to be in Canada.’’

Dolly Varden said $6 million of the net proceeds of the offering will be used for exploration, mineral resource expansion and related costs in the Kitsault Valley project, with the balance to be used for working capital and G&A costs.

Dolly Varden shares advanced on the news, rising 2.8% or $0.02 to 72 cents. The shares trade in a 52-week range of $1.24 and 56 cents.

In connection with the offering, Dolly Varden has agreed with Hecla that the company will not complete any further debt of equity financings for the remainder of 2023. Additionally, Dolly Varden has agreed that between January 1, 2024 and September 1, 2024, without the consent of Hecla, it will not complete any debt or equity financings other than equity financings for net proceeds to the company of up to $15 million and provided that the issue price under such financings is greater than $0.65 per security.

Dolly Varden is focused on advancing the wholly-owned Kitsault Valley Project, which covers 163 square kilometres and hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge along with the past producing Dolly Varden and Torbit silver mines.

The entire property is considered to be highly prospective for hosting high-grade precious metal deposits since it comprises the same structural and stratigraphic setting that hosts numerous other on-trend, high-grade deposits, including Eskay Creek and Brucejack.

The property is also considered to be an advanced exploration stage property with targets that are well understood. However, the company has said mine restarts will require the discovery of additional silver resources and the confirmation of historic resources that were known at the cessation of mining in 1959.

Dolly Varden is a member of the British Columbia Regional Mining Alliance (BCRMA), which was set up by the B.C. Government along with First Nations, and several exploration companies from B.C.’s northwest region to promote B.C.’s mining opportunities internationally.

Schon mal die Vorankündigung:

Hecla Mining Company (NYSE:HL) will release its third quarter 2023 operational and financial results after the market close on Monday, November 6, 2023.

Hecla Mining Company (NYSE:HL) will release its third quarter 2023 operational and financial results after the market close on Monday, November 6, 2023.

Antwort auf Beitrag Nr.: 74.633.786 von Dirkix am 14.10.23 00:28:24

Was geht...

...ja, Gedult ist eine Tugent.

Antwort auf Beitrag Nr.: 74.625.500 von Rolandbock22 am 12.10.23 17:51:47

Und, hast du deinen Kauf schon bereut...?

Zitat von Rolandbock22: Hatte auch welche gekauft...war ja wohl der klassische Griff ins Klo...gruselig

Und, hast du deinen Kauf schon bereut...?

Hallo Fee Puh das war knapp aber am Ende iset immer noch jut jejangen ich wünsch dir ein schönes Wochenende hoffentlich kommt es zu keinem große Rückläufer mehr dann könnte der Wochenausklang nicht besser sein bis danne.

Hallo Fee vielleicht solltest du dir schon einmal bei deiner Bank erkundigen wie hoch der Zinssatz zur Zeit ist ,den bei diesem Tempo natürlich wie immer nur nach unten wird es für die 2,3 wohl nicht mehr lange dauern.

Antwort auf Beitrag Nr.: 74.579.519 von Dirkix am 03.10.23 16:51:09Hatte auch welche gekauft...war ja wohl der klassische Griff ins Klo...gruselig

29.05.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

19.05.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

16.05.24 · wallstreetONLINE Redaktion · Hecla Mining |